There was a time when debts were seen as heinous things most people tended to stay away from until absolutely necessary. However, with changing times, as it became easier to make money, more and more people started relying on credit cards and EMIs to purchase not only their needs but also the luxuries that they desired. For instance, iPhones are the best any smartphone could get, which is why they have a high global popularity. For anyone belonging to a middle-class household, it’d be impossible to pay Rs. 60,000 for a phone, that too at once. Here’s where EMIs come in.

The equated monthly installments help buyers make their purchase without making the complete payment at once; instead, they pay a small sum of money for the same every month until they’ve paid the full amount (often with an added interest).

EMIs have simplified the shopping experience of countless middle-class households. Even more so now that they can even be applied for with a debit card.

In this sale season, where it’s raining discounts and offers left and right, you must think about making that purchase you’ve been waiting so long for. Is it a bluetooth earphone? Or a brand-new smartwatch? Or do you need an additional monitor screen to simplify your WFH? Whatever your needs are, you’re bound to find it on Flipkart.

This Indian e-commerce giant has won the heart of all Indian customers by launching debit card EMIs options on all its products. However, some of our readers have been coming to us with an issue of eligibility for debit card EMIs on the shopping app.

If you’re one of those, we’re here to lend you a helping hand. Keep reading till the end to figure out why you’re facing this issue and how to resolve it. Let’s get started!

Why am I Not Eligible for Debit Card EMI on Flipkart?

So, we understand that you were trying to buy something on Flipkart using the Debit Card EMI payment option but failed to do so. If you, too, received a message stating that you’re not eligible for Debit Card EMI, we have a good idea of what could’ve gone wrong here.

After talking to a large number of our readers, we were able to narrow down the reasons behind this issue to two strong possibilities. Below, we’ll explore them both in detail and figure out how to deal with them.

Reason #1: Have you checked your CIBIL score?

How many of you are familiar with the concept of the CIBIL score? For those of you who aren’t, the CIBIL score is a credit scoring system referred to most commonly in the finances of Indian citizens.

Short for Credit Information Bureau (India) Limited, CIBIL score is a 3-digit number ranging between 300 to 900. As you can imagine, the closer your score is to 900, the better your credit rating.

Now, if your CIBIL score falls below 600, it’s considered below average by both the banks and e-commerce platforms like Flipkart, Amazon, and more.

So, one possibility that you’re not eligible for debit card EMI on Flipkart is your low CIBIL score.

To make sure this is the problem in your case, all you need to do is check your CIBIL score here once. It’s completely free of cost, but you might need to enter your PAN details, so keep the card handy while doing so.

Fix:

Unfortunately, there is no quick fix for the CIBIL score. The whole process is longer than you’d think. However, even if it doesn’t help you with this particular purchase, it’s always better to strive for a higher CIBIL score. In the long run, it can help you a lot financially.

Here are a few suggestions on how you can improve your CIBIL score:

l Do not take too many loans or credit debts at the same time. Wait to pay off one before taking the next one. l Always pay your EMIs in a timely manner; any lapse or delay can put a huge dent in your score.

l Opt for a longer tenure when you apply for loans.

l Review your credit report timely (twice a year) and report any discrepancy you find to your bank.

Reason #2: Perhaps your purchase history is the issue

If you checked your CIBIL score and found it to be perfect, then it’s time to explore the next possibility: a shaky purchase history on the app.

While your CIBIL score plays a key role in enabling your debit card EMI payment option, the platform you want to use this option for also has its own checklist.

For instance, let’s take Flipkart. This e-commerce store also runs a check of your account activities once your CIBIL score has been approved. In this inspection, all the purchases you’ve made from the store are checked. The main objective is to see how authentic a buyer you are.

So, if, in your purchase history, they find more returns and cancellations than fulfilled orders, that might be a deal-breaker for Flipkart.

Fix:

If your purchase history on Flipkart is questionable, it probably indicates that Flipkart doesn’t trust you enough to offer you an EMI payment option. In such a case, there is no immediate solution but to improve your purchase behavior going forward.

However, because we believe you deserve a chance at all costs, if you have an explanation for your shaky purchase history, we’d recommend you to get in touch with Flipkart’s customer support to talk about it.

You can share with them your challenges and get their help in exploring the current possibilities for your eligibility for debit card EMI. Their customer support contact number is 044-45614700. Alternatively, you could also mail them to grievance.officer@flipkart.com.

The bottom line

With this, we’ve wrapped up our blog for the day. Our topic of discussion today revolved around the debit card EMI option on Flipkart.

We started by talking about why you could be struggling with the eligibility of this payment method. We explored two major possibilities and discussed how each one of them could be fixed.

Our ultimate suggestion to you was to get in touch with the customer support department of the e-commerce giant.

Do you have more questions about purchases on Flipkart? Share them with us in the comments below, and we’ll come back with their solutions soon!

Also Read:

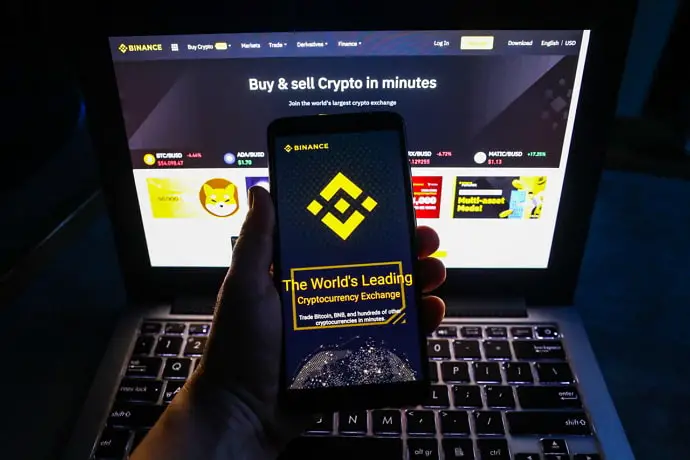

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Lido Staked Ether

Lido Staked Ether