Experiencing seamless transactions is a must in financial dealings. Especially if you use online ways to transfer money, you care for secured, streamlined, optimized, and seamless transactions. Two such online money transaction applications are PayPal and Cash App. Amongst the most famous online payment apps worldwide, these applications take just a few seconds to transfer money safely.

Online payments have made their way into the day-to-day life of people. Such applications have now started incorporating ways that engage more and more people.

In such a case, people have made accounts on different apps and now prefer to transfer from one app to another.

But how do I transfer money between Cash App and PayPal application? Check the details below.

How to Transfer Money from Cash App to PayPal

Though they both are among the most popular money transfer apps, there is no direct link between these two. For transferring money, you can try these methods.

1. Bank Account

A bank account can be a solution to this. You can do money transactions between these apps by transferring an amount of the cash app to your bank account. Later on shift this money from your bank account to the PayPal app.

- First, open the Cash app and log in to your account.

- Go to Cash app balance, and choose the Transfer option.

- Enter the desired amount you want to withdraw.

- Tap on the submit button. Now your money has been sent to your bank account. These are the further steps.

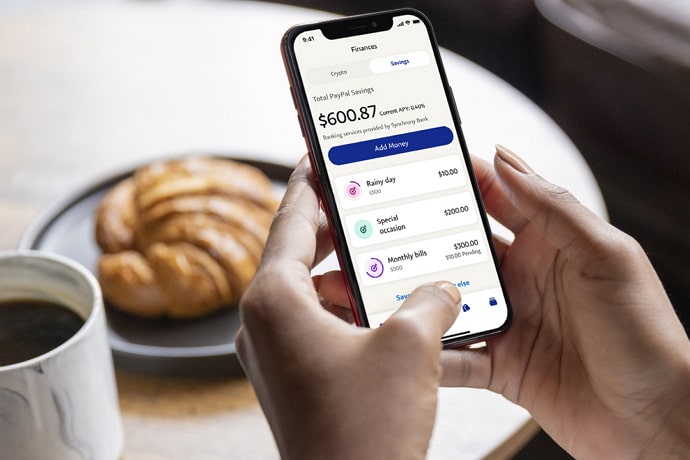

- Log in to PayPal and tap on Add Money option.

- Enter the amount in the given box. Tap Submit button.

It will take 3-4 days to transfer this money completely.

2. PayPal Cash Plus Account

- Download both apps and open PayPal.

- Select the gear symbol on the top right of the screen of the PayPal app.

- It will lead you to direct deposit.

- Post that PayPal account number and 9-digit ABA routing number will be visible on your screen.

- Note down these numbers.

Now we are done with the first half. Next steps are:

- Start Cash App.

- Go to “Balance” option.

- Now go to “Cash Out” option.

- Type the amount you wish to exchange.

- Now select the green cash out button.

- Select Stansted Transfer and then add your bank.

- Now the app will ask you for routing numbers that you saved earlier. Write them and press “next.”

- The app will ask for confirmation.

- You will get a final “done” option in a few seconds.

Please select it, and your transfer process is done.

Also Read:

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Lido Staked Ether

Lido Staked Ether